Pound Cost Averaging: A Steady Approach to Investing

Introduction

When it comes to investing in the financial markets, there are numerous strategies to choose from. One such approach that has gained popularity over the years is “Pound Cost Averaging” (PCA).

This investment strategy is based on a simple principle and aims to reduce risk and maximize returns over the long term.

In this article, we will delve into the concept of Pound Cost Averaging, how it works, its advantages, and how you can implement it to build a robust investment portfolio.

What is Pound Cost Averaging?

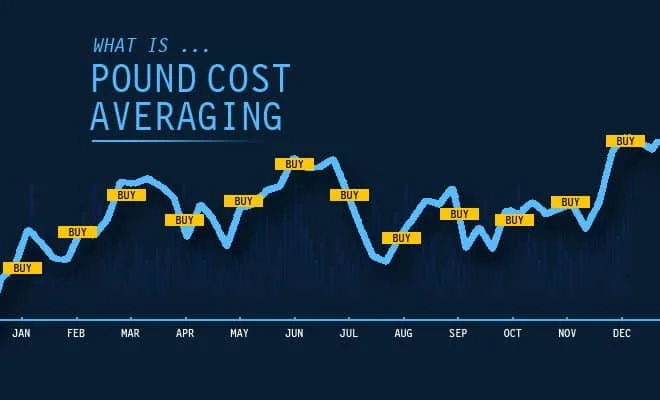

Pound Cost Averaging is an investment strategy where an investor contributes a fixed amount of money at regular intervals, regardless of market conditions.

By doing so, the investor ends up purchasing more shares when prices are low and fewer shares when prices are high. This averages out the overall cost of acquiring assets over time and can lead to potential benefits, especially in volatile markets.

In contrast to Pound Cost Averaging, Lump Sum Investing involves investing a single large sum of money into the market all at once.

While this approach may work well if the market is bullish, it exposes the investor to higher risks if the market takes a downturn shortly after the investment.

How Does It Work?

To implement a Pound Cost Averaging strategy, follow these steps:

Set Investment Amount and Interval: Determine the fixed amount you will invest regularly (e.g., monthly) and the interval at which you will make these investments.

Choose the Investment Vehicle: Select the investment asset or portfolio that aligns with your long-term financial goals.

Stick to the Plan: Remain consistent with your investments, regardless of market fluctuations, to maintain the benefits of PCA.

Calculating Average Purchase Price

The formula to calculate the average purchase price in Pound Cost Averaging is relatively simple. By dividing the total amount invested by the number of shares acquired, you can find the average cost per share.

Advantages

One of the significant advantages is its ability to reduce the impact of market volatility on the overall portfolio. By spreading out investments over time, the investor is less susceptible to the fluctuations of the market.

PCA is also beneficial in eliminating emotional decision-making in investing. Investors often get influenced by market sentiment, leading to impulsive decisions.

By following a fixed investment schedule, emotions are taken out of the equation, allowing for a more disciplined approach.

When is it Suitable?

Pound Cost Averaging is an excellent strategy for long-term investors who prioritize consistent growth and are willing to weather short-term market fluctuations for potential long-term gains.

Investors can tailor their PCA approach based on their financial goals, risk tolerance, and time horizon. Whether it’s retirement planning, saving for education, or achieving other milestones, PCA can be adapted accordingly.

Comparing with Other Investment Strategies

While Lump Sum Investing may be more suitable for investors with a significant amount of surplus funds, it provides a more structured and risk-mitigating approach for the average investor.

Though similar in concept, Dollar Cost Averaging and Pound Cost Averaging differ in currency used for investments. While the former applies to investments made in dollars, the latter refers to investments in British pounds.

Common Misconception

Like any investment strategy, it has faced its share of criticism. We address some common misconceptions and provide clarity on how PCA can still be a valuable tool in an investor’s arsenal.

Understanding the underlying principles of Pound Cost Averaging is crucial to making informed decisions about its implementation in an investment portfolio.

Tips for Implementing a Strategy

The frequency of investments can significantly impact the success of PCA. We explore the best practices for determining the optimal investment intervals.

A well-diversified investment portfolio can further enhance the benefits. We discuss how to diversify across various asset classes.

Real-Life Examples

Learning from the experiences of successful investors can provide valuable insights into how Pound Cost Averaging can work effectively in real-world scenarios.

Limitations

While it offers many advantages, it’s essential to be aware of its limitations and potential drawbacks to make an informed investment decision.

Combining it with other investment strategies can create a well-rounded portfolio that aligns with individual financial goals and risk tolerance.

Conclusion

Pound Cost Averaging is a time-tested investment strategy that offers numerous benefits to long-term investors.

By staying consistent with regular investments and adhering to a disciplined approach, investors can potentially achieve their financial objectives while minimizing risks associated with market volatility.

For more useful posts about Finance, Business, Marketing and Tech, check the rest of our blog.